Coppice HR

HR NewsImportant HR Changes Happening April 2022 That Business Owners Need To Be Aware Of…

Ensure your HR procedures & policies maintain effective from April 2022 to avoid costly consequences.

As we’re nearing the end of the financial year again, businesses can expect to see lots of new vital changes and significant improvements being made. Each year, Employment Laws are changing to take additional essential steps towards becoming far more inclusive.

What Changes Can Business Owners Expect In April 2022?

National Minimum Wage Changes

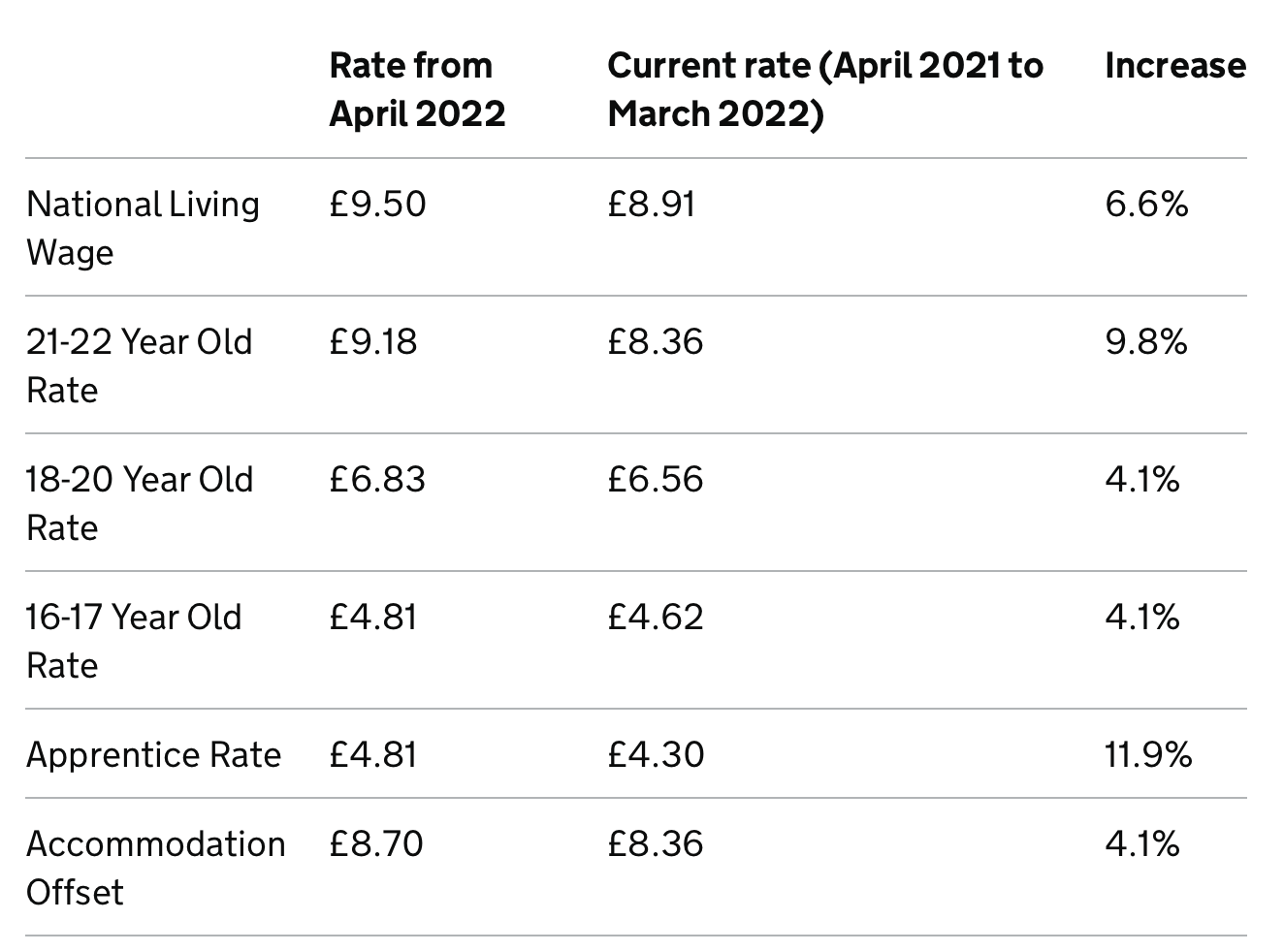

Changes to the National Minimum Wage (the minimum hourly amount that every employee is entitled to be paid under the National Minimum Wage Act 1998) will take place from 1st April 2022, with the biggest increase in the minimum wage this year being the apprenticeship rate at 11.9%.

With just a couple of months to go before these changes take place, as a responsible employer, you should familiarise yourself with these new minimum wage rates to ensure your staff wages are reflective.

National Minimum Wage Rates Starting April 2022…

(Image and figures taken from Gov.uk website)

Employers that fail to comply with national minimum wage rules may be subject to criminal prosecution, penalties and being publicly named.

The six potential criminal offences (s.31 of the National Minimum Wage Act 1998) are:

-

The employer refuses or wilfully neglects to pay the national minimum wage

-

A person fails to keep or preserve records

-

A person knowingly causes or allows false entry in records

-

A person produces or furnishes false records or information

-

A person delays or obstructs a compliance officer

-

A person refuses or neglects to answer any questions or produce documents for a compliance officer.

Readers Also Liked: Are Your HR Procedures & Policies Up To Date? Check Your HR Compliance In Under 5 Minutes

Digital Right To Work Checks

The Government has confirmed that the use of the digital right to work checks will be a permanent fixture starting from April 2022, but there are concerns it will be unaffordable for some firms. Whilst the digital system was a temporary adjustment during the peak of the pandemic, it is now set to stay.

From 6 April 2022 employers will be able to use government-certified identification document validation technology (IDVT) to check British and Irish citizens’ right to work. The Home Office said that using IDVT will allow job candidates to upload images of their documents instead of presenting physical documents to a prospective employer.

It is essential that employers who consider employing staff from outside of the UK are aware that they can utilise this digital system to check a potential employee’s eligibility for employment within the United Kingdom.

Until the system is launched, employers must follow the current (manual) right to work checks guidance.

Gender Pay Gap Reporting

Under the Equality Act 2010 (Gender Pay Gap Information) Regulations 2017, relevant employers in the private and voluntary sectors are required to publish gender pay gap information on an annual basis. There are separate but parallel gender pay gap reporting obligations for public-sector employers.

Employers must calculate the differences in mean pay, median pay, mean bonus pay, and median Employers must publish six metrics for each subsequent year. The six metrics are set out in the Regulations as:

- The difference in the mean hourly rate of pay between male and female full-pay relevant employees

- The difference in the median hourly rate of pay between male and female full-pay relevant employees

- The proportions of male and female full-pay relevant employees in each of the four quartile pay bands

- The difference in mean bonus pay between male and female relevant employees

- The difference in median bonus pay between male and female relevant employees

- The proportions of male and female relevant employees who received bonus pay

If companies do not report (or results are inaccurate) they will be in breach of the regulations which could lead to court orders and fines.

However, perhaps more damaging would be a reputational risk. This could impact recruitment. Indeed, an action plan which explains how the company is going to address the situation is recommended. It could look at:

- Gender pay gap recruitment, including starting salaries

- Performance ratings and promotions, including men and women ‘getting stuck’ at different levels

- Exit rates

- Other factors, for example, bonus payments or support of part-time work and parental leave and its impact on progression

Should you need any support updating your HR procedures and policies to align with these new changes being enforced from April, please get in touch with Paul from Coppice HR by emailing paul@coppicehr.com or calling 07814 008478.